It’s no secret you to definitely guaranteeing earnings away from home loan candidates are tedious. To have financial features providers, it’s time-drinking, error-susceptible, and you will a factor to waits from the loan cycle. For customers, it is a disturbance, demanding tracking down records and you will yourself inputting suggestions. Back-and-forward between financial features organizations and you will users is typical with this procedure while they work to rectify discrepancies. And in advance of closing, the lending company could need to re also-be sure money, demanding the consumer to search for and supply upgraded documentation.

Existing electronic verification choice address some of these situations but tend to just coverage a narrow group of customers and you may money items. Financial services providers are stuck which have a lot of legwork, related to determining and vetting investigation providers, cobbling together with her a natural provider, and you may controlling a process that is not incorporated into the program flow.

We recently announced Mix Earnings Confirmation to simply help mortgage lenders deliver a sleek user experience while increasing loan party performance that have quick verification. To understand more about the power of this new provider, let us examine the way it assists address some typically common challenges in mortgage handling workflow.

A streamlined feel to own customers

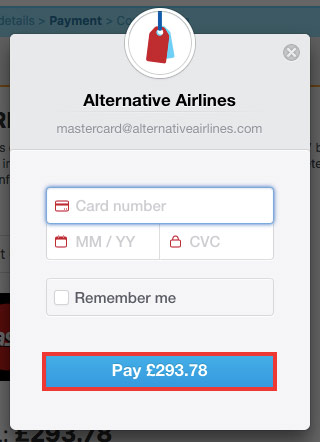

Combine Income Confirmation utilizes leading earnings investigation company and you may verification strategies to assist economic services businesses send immediate confirmation inside the app procedure.

Instead of by hand typing suggestions, users could only verify the accuracy cash research pre-filled throughout the app. Since it is incorporated into the borrowed funds software disperse, its offered while consumers are involved. When the time comes getting closure, consumers need not track down its most recent income information. Alternatively, economic features organizations could possibly only lso are-ensure the information and knowledge inside Merge.

Hurdles and you will disruptions was substituted for a simple workflow having users, helping be certain that a smooth experience throughout the home loan application.

A robust service to own monetary qualities providers

Combine Income Confirmation cannot simply streamline the user sense, in addition it allows economic functions businesses when deciding to take a proactive means to help you money verification.

Verification takes place in the a life threatening part of the loan lifecycle – immediately. Having validated pointers, loan providers can build told choices, and qualifying consumers and structuring loans, earlier along the way. This helps end downstream delays.

Confirmed income info is designed for processing https://paydayloan4less.com/payday-loans-ok/ and underwriting prior to, reducing touchpoints and you may possibly providing economic services firms romantic fund shorter. Blend are an authorized declaration merchant for both Fannie Mae’s Pc Underwriter (DU) recognition services and you will Freddie Mac’s advantage and money modeler (AIM), helping loan providers easier make the most of this type of software.

On top of that, we now have customized Merge Money Confirmation to improve just how many people to own which income will be digitally verified, so economic characteristics companies normally loans alot more finance with certainty.

A softer part of a smooth prevent-to-avoid financial

A far better verification procedure is just one of advantages monetary attributes agencies can experience whenever following the Combine Mortgage Suite. I invest the information to determining and you can improving abreast of the absolute most frustrating components of the loan processes. With powerful devices to own loan teams, automation in order to stamina working performance, and a smooth, self-serve electronic experience to possess customers, we have been changing the homeownership travel away from software to shut.

What’s going on next

The audience is usually trying to iterate to your our approaches to bring top-in-category technical to help you economic characteristics firms in addition to their people. We’re trying to make Mix Income Verification designed for our User Banking Suite in a few months so loan providers increases returns and you can glee users around the products.

The audience is and tough of working on adding investment-derived income verification, which may ensure it is economic functions agencies to confirm money using investment comments that include a consumer’s current information during the its monetary qualities agency. We feel this will help loan providers continue to improve coverage during the less prices for themselves, and provide a level easier procedure getting customers. Asset-derived money was built-in with the future of earnings verification – and you will we have been excited to make it offered to consumers on weeks in the future.